Special shout out to Kara Rodby PhD (Technical Principal @ Volta) whose research at MIT provided the backbone of this thesis. Please let us know if you would like to be connected with her. She is brilliant.

— Fund Developments —

NY #TechWeek Event: Investing in Resilience with Steel Atlas + AlleyCorp + EIF

Thank you to all who showed up for our event with AlleyCorp and EIF on investing in resilience. Topics covered included Joseph’s contrarian take against dual-use technologies (government + commercial) at the early stages, how to deal with timeline risk investing in hardware, and how to model grid level resilience and data center efficiency.

— Thesis and Commentary —

A Priori Sourcing Validation – Manganese Threatens Lithium Batteries

As discussed in our memo on Sourcing Resilience, we hypothesized that we could use what we call “a priori” sourcing to predict opportunities for investment. We do this by identifying sectors at high risk of volatility due increasing probabilities of volatility inducing events paired with an increasing value of exposed elements.

Total Risk = ∫ [Σ (probability of event) x Σ(value of exposed human & economic variables)]

In our memo on the battery supply chain, we predicted that the supply chain for lithium-ion batteries (LiBs) showed high and increasing risk due to an over-concentration of rare earth element production in China. From the memo:

“China's dominance in this sector is concerning. The Democratic Republic of the Congo and China were responsible for some 70% and 60% of global production of cobalt and rare earth elements respectively in 2019. The level of concentration is higher for refining, where China’s is around 35% for nickel, 50-70% for lithium and cobalt, and nearly 90% for rare earth elements ... High levels of concentration, compounded by complex supply chains, increase the risks that could arise from physical disruption, trade restrictions or other developments in major producing countries.”

Our prediction of over reliance on China driving volatility in the battery supply chain has come true faster than we expected. China's once-mighty industrial magnates are being dismantled from some combination of financial mismanagement and government pressure. Prominent figures like Li Hejun, the former richest man in China known for his solar-panel business, and Liu Zhongtian, who built Asia's largest aluminum company, have faced legal and financial challenges. Evergrande's Hui Ka Yan and He Jinbi, the heads of a major copper-trading house, have also been detained. The most recent continuation of this pattern now threatens the supply of manganese, a critical material for the production of LiB cathodes.

Jia Tianjiang, a 61-year-old billionaire behind a global manganese empire, had his company, Tianyuan Manganese Industry (TMI), placed into administration on Sept. 22nd 2023 due to mounting debts. Tianjiang’s company was an integral part of the CCPs plan to own the battery industry. TMI had plans with the CCP to become the world’s largest producer of manganese sulfate annually (1M+ tonnes). More on this from The Economist here.

Although it is unlikely that the Chinese government will allow the full collapse of TMI, volatility in the supply of manganese (and thus LiBs) should be expected. This is why we are so excited about our investment in Group1, an engineering materials company focused on the commercialization of potassium-ion batteries (KiBs). These batteries enable a domestic supply chain because they use abundant raw materials in North America and do not contain many critical minerals like cobalt, nickel, copper and lithium.

However, manganese has important applications beyond LiBs, notably steel alloying. A threat to manganese supply will lead to volatility in the steel market – a large market that is already at risk due to the precarious nature of sourcing vanadium. We highlight the risks in the vanadium supply chain and the investment opportunities emerging from that next.

Vanadium Volatility Opportunity – The Critical Mineral for Strengthening Steel

Before sharing our thesis on vanadium, the world's most widely used alloy for strengthening the steel required to construct bridges and buildings, a preamble is necessary. These updates are a growth driver for our firm. Our events are oversubscribed, our companies receive funding from GPs receiving these updates, and our deal flow continues to become more qualified and specialized. This means more alpha for our LPs.

To this end, we are fortunate to have readers that refer us to relevant experts capable of guiding us to important but largely unknown sources of volatility. Our analysis of vanadium is a perfect example of this. We were connected with Kara Rodby PhD. She is brilliant and wrote this research paper at MIT that is the backbone of our analysis. If you enjoy it, please reach out. We would be happy to connect you with her!

Kara Rodby PhD is a Technical Principal at Volta Energy Technologies, an energy storage hard tech focused VC firm. At Volta, she leads technical due diligence on half of their dealflow, primarily in beyond-lithium ion storage technologies. Before Volta, she earned her PhD in Chemical Engineering at MIT, with a thesis focused on techno-economic design of redox flow batteries for the grid. As a part of this work, she studied the vanadium supply chain in relation to vanadium flow battery deployment potential. We will be referencing her published paper regularly to make clear the absolute importance of this critical metal.

So why should you care about vanadium? Vanadium, when introduced to alloys, notably steel, enhances specific characteristics that are critical for many industrial applications. It imparts increased tensile strength, toughness, and wear resistance. Furthermore, vanadium microalloyed steels display superior weldability and a notable resistance to atmospheric corrosion. These attributes make vanadium alloys indispensable in sectors like construction, automotive, aerospace, and energy.

The problem with vanadium is price volatility – in the last five years there has been a 10x difference in the max and min price for vanadium pentoxide (the most common form of vanadium sold on the global market).

Vanadium is sourced from two categories of vanadium bearing compounds, mined-shale / sandstone-hosted deposits and waste products of carboniferous materials (coal, crude-oil, etc). Vanadium is only found at low concentrations in minerals from the Earth (<5 % by weight vanadium pentoxide). This results in vanadium being extracted as a complement to other materials, notably iron for steel. This leads to production breakdown seen below:

The vast majority of vanadium (~75%) is produced as a by-product to steel making. The steel mills that produce this bulk of the global vanadium supply use a “duplex process” to extract vanadium from iron ore. This means adding a step that selectively oxidizes vanadium to make it easier to recover. Performing the duplex process increases the cost of steel production. It is therefore only profitable to pursue the duplex process if the vanadium content in the iron ore is exceptionally high. Therein lies the problem (and thus opportunity) in vanadium markets.

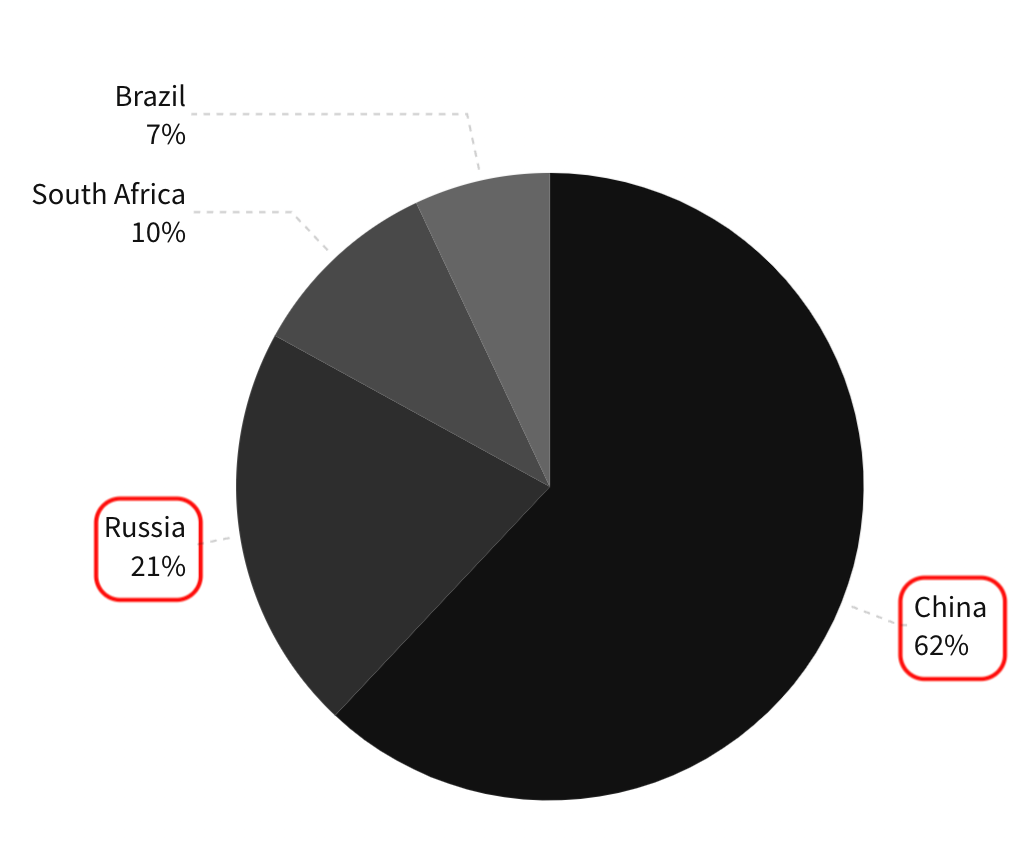

Due to the required concentration of vanadium in iron ore for profitable by-product extraction, Vanadium production is concentrated in 10 steel mills across China (62%) and Russia (21%) that account for the majority of global supply. This concentration in just 10 mills creates incredible volatility risk. This led the US Department of the Interior to declare vanadium one of 35 critical minerals – minerals that are integral to the US economy and security.

The risk of this highly concentrated supply materialized for the first time in 2016 when Highveld Steel & Vanadium in South Africa (formerly the world’s largest vanadium producer) went bankrupt decreasing global supply by ~11%. Just as this hit to the market was being addressed by new principal production coming online in Brazil in 2019, China updated their standard on the composition rebar, requiring higher vanadium concentrations. These two factors resulted in dramatic volatility at the end of 2018, with the price peaking at 10x the price in early 2016 (prior to the South Africa closure).

The importance of diversifying the vanadium supply chain cannot be underestimated as the problem was exacerbated by further concentration in China. Global vanadium production expanded by ~20% in 2019 and 2020 from steel-making in China. However, we cannot expect this diversification to come from kickstarting the duplex process in new geographies like the US. Not only does the current duplex process only recover ~50% of vanadium, the cost disadvantage of running the duplex process as compared to single-step processes will likely mean that they are phased out over time due to economics. The duplex process makes current facilities less profitable than competitors. As these steel mills go out of business or require replacement over time, it is unlikely that new facilities designed for vanadium extraction will replace them (without government subsidies or novel technologies that increase extraction efficiency or decrease cost).

However, improving the efficiency of the duplex process to unlock geographic diversification is not the only path to stabilizing volatility in the vanadium supply chain. We see three paths, one of which we believe has the potential to be fertile ground for a venture-backable business that we would potentially like to support:

- Primary Supply Expansion – there are areas in South Africa and Brazil with sufficient concentrations of vanadium to justify mining. Even without new technology, durable price increases in vanadium or sophisticated underwriting could get these projects off the ground. We do not view this as a venture opportunity.

- Slag Extraction – steel mills that do not run the duplex process produce slag rich in vanadium-calcium, a compound that is notoriously costly to extract vanadium from. You could develop a technology for cost-effectively extracting vanadium from this slag, deploying said technology across steel mills globally. This opportunity is currently being pursued by companies like Neometals (a public company) in Sweden.

- Sour Crude Extraction [Steel Atlas Investment Target] – sour crude (common in Venezuela and Saudi Arabia) is high in sulfur and other minerals like vanadium vs sweet crude (common in US shale) which is low in sulfur. Burning sour crude oil yields a vanadium-rich ash. As part of the oil refining process, vanadium already must be removed, however it is not currently extracted for sale as vanadium pentoxide [source]. We believe that developing a cost effective technology for vanadium extraction from sour crude that can be deployed at existing oil refining (especially in Saudi Arabia) represents a venture scale opportunity where we have the relationships to accelerate commercialization.

Simply put, we see the deployment of vanadium extraction technology from sour crude as the key enabler of near-term growth and supply chain diversification in line with the large geopolitical tailwinds of re-shoring and “friendshoring” (as previously discussed in our analysis of the emerging multipolar world). As of today, vanadium rich waste from oil refining is currently sold to vanadium producers in small batches. This creates inefficiencies. We believe, like Kara Rodby PhD, that integrating vanadium extraction directly into the refineries could significantly cut costs and scale output of vanadium pentoxide available globally.

Although there were patents filed in the mid 2000s focused on vanadium extraction via microwave chemical methods [South Korean Patent, Chinese Patent], these do not appear to be the scalable solution the market is looking for. Our goal is to identify early stage companies or academics developing solutions to this challenge. If you know someone working on vanadium extraction from sour crude, please reach out!

Talal’s family are the legacy steel distributors in Saudi Arabia. Thus, this problem not only has macroeconomic significance, but also hits closer to home. Just like we need alternatives for lithium-ion batteries and the rare earth metal production concentrated in uncertain supply chains, we need alternatives for the production of vanadium – the world’s most highly used micro-alloying elements for strengthening steel.