In our interactions with public and private industrial entities, waste valorization, the process of transforming waste materials into valuable products, has become an increasingly common topic of conversation. This is driven by two factors, climate awareness and national security. These two factors are putting a "premium" on technologies that mitigate environmental impact and provide pathways to localizing the supply of key assets. In this thesis, we look at why waste valorization is gaining more attention and which types of businesses/technologies are appropriate for venture investment.

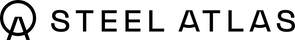

By transforming waste into energy, raw materials, or useful products, waste valorization helps mitigate the negative effects of waste disposal and decreases the reliance on virgin resources. Waste valorization supports sustainable development by turning potential liabilities into assets, thereby fostering a more balanced and stable economic system. Thus waste valorization aligns directly with our thesis of investing in resilience enabling technologies touching many of the key industrial sectors we focus on as shown in the table below.

The two forces driving the urgency of waste valorization today are the climate crisis (demanding sustainable practices) and the shift towards deglobalization (demanding national security via self-sufficiency). These forces are placing a premium on capturing value from waste streams that under other conditions would be economically inviable. This is driving renewed attention and investment in waste valorization. Despite these tailwinds, we remain cautious.

1/ Climate Crisis and the Green Premium

The climate crisis necessitates a shift towards sustainable practices. Governments and consumers are increasingly willing to pay a "green premium" for environmentally friendly products and processes. Waste valorization aligns with this trend by reducing waste, conserving resources, and minimizing environmental impact.

2/ Deglobalization and the National Security Premium

Deglobalization and national security concerns are driving countries to become more self-reliant. This trend emphasizes the importance of localizing supply chains and extracting value from domestic resources. Waste valorization supports this by transforming waste into valuable products, reducing dependency on global supply chains, and enhancing economic resilience.

High vs Low Value Valorization

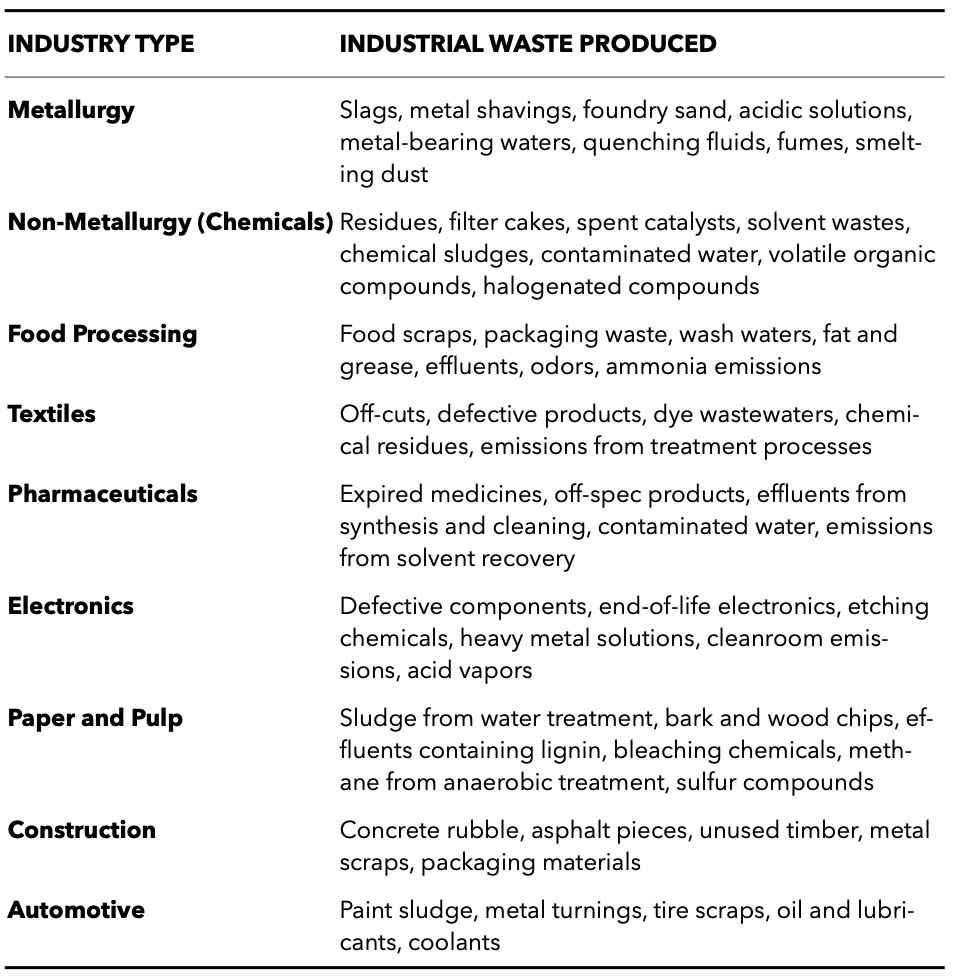

When evaluating waste valorization technologies, we believe the most important vector of consideration is value of the end product. Waste valorization processes that produce low value commodities, should be avoided as their success will be dependent on achieving scale relative to competitors with larger volumes of preferred inputs.

Low-Value Valorization → Generates products that require minimal processing and have lower market value, such as compost, animal feed, and biogas. These processes generally require more volume and less technology. Additionally, a significant portion of the waste valorization market produces downgraded or lower-quality versions of original materials, leading to limited economic viability. Given the lower value of these products, these businesses will require larger scale to drive returns relative to high value.

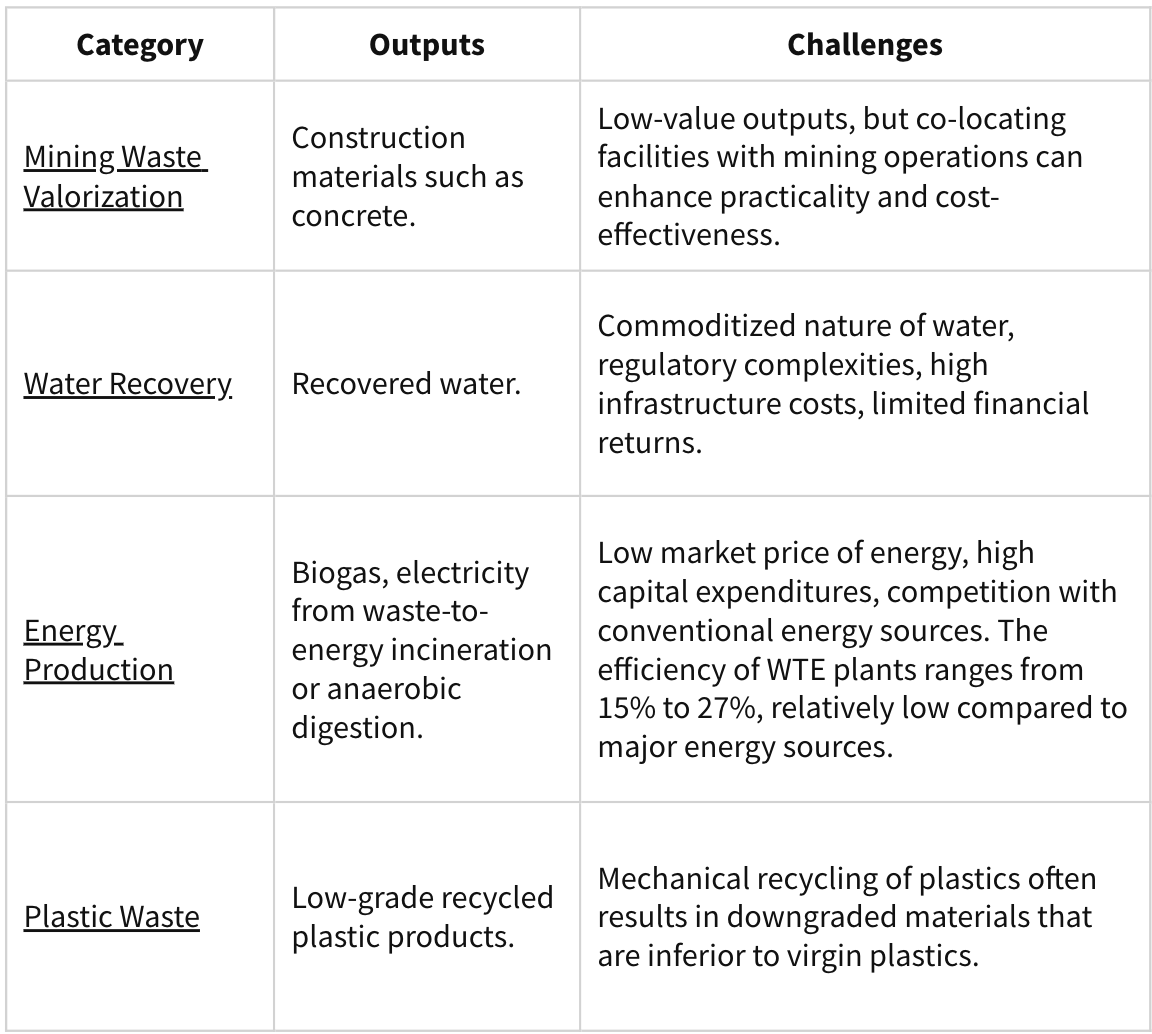

High-Value Valorization → Involves more complex processing to create high-value products, such as specialty chemicals, advanced materials, and high-purity biofuels. These processes often require less work and more technology. Given the higher value of these products, businesses targeting high-value valorization will require smaller scale to drive returns. This makes these business more attractive for venture investment. However, there have been limited cases where the upfront investment in these technologies has been worthwhile.

Features of Investable Waste Businesses

Paid to Process + Process to Sell

Our favorite type of waste valorization business (and inherently the hardest to get right) is one where you are paid by one party to process waste and where you can sell the processed good from that waste to another party. The customer in the first leg is often a government body, but not exclusively. A lack of clear enterprise customers ready to purchase the output at scale can signal a poorly defined go-to-market strategy. This is particularly concerning in sectors where the end product lacks differentiation or where market demand is untested or volatile. This can also make it very difficult to collect crucial off-take agreements or even LOIs that can enable first of a kind (FOAK) project finance. An example where this goes right is Windfall Bio.

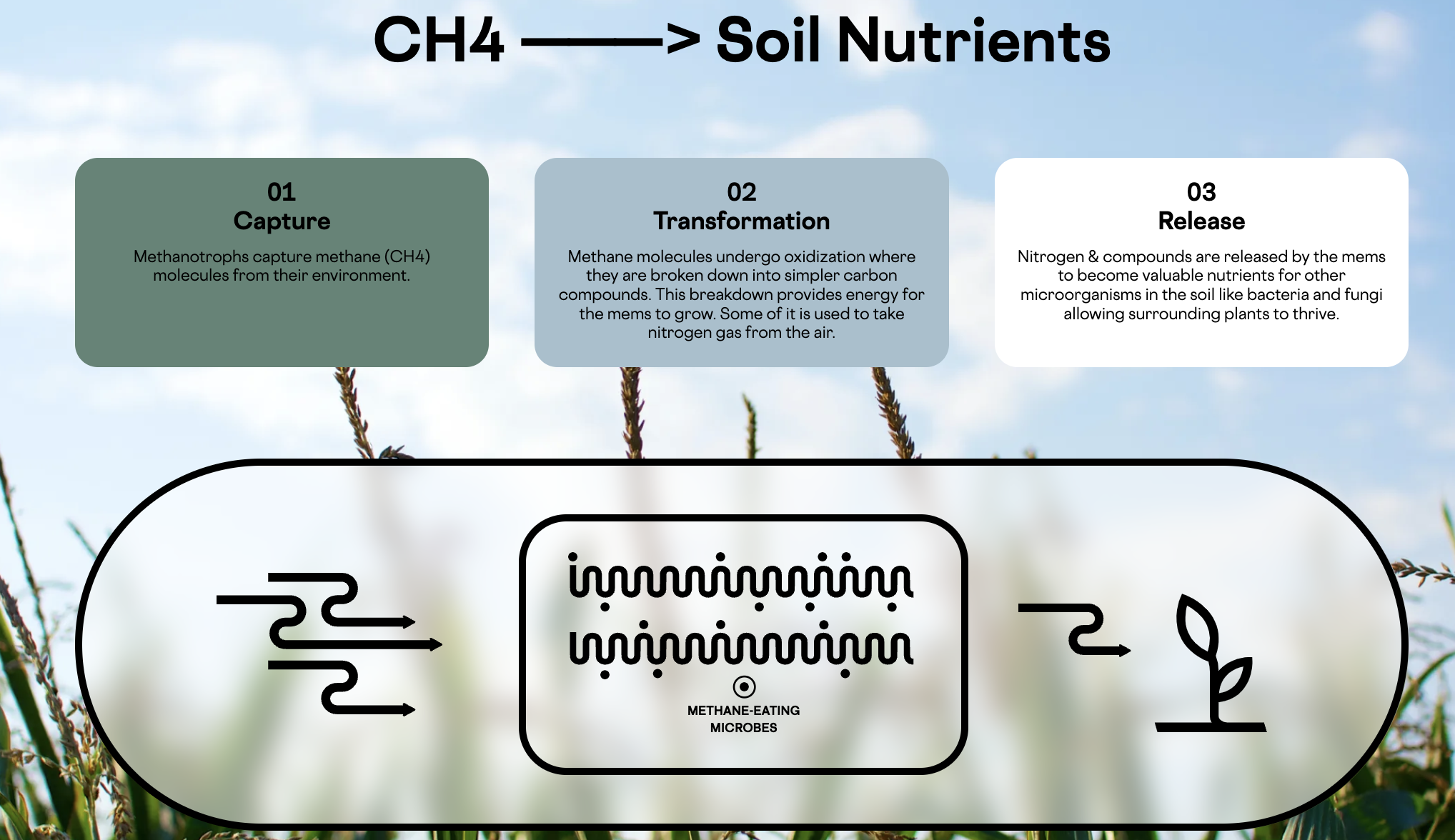

Windfall Bio is pioneering a processes to convert methane into nitrogen for fertilizers. They use membranes of microbes at the industrial exhausts to transform greenhouse gases into essential agricultural inputs, thereby reducing dependency on synthetic nitrogen sources. Windfall Bio is paid by refineries to reduce their methane output while selling valuable nitrogen to agricultural firms.

To ensure defensibility, look for processes that are inherently complex and hard to replicate, serving as a natural moat against competition. A strong patent portfolio, particularly around catalysts (whether chemical, biological, or mechanical) or reactors, adds a layer of protection and enhances the company’s competitive edge. Developing unique catalysts increase the efficiency, yield, or purity of the product from waste transformation processes. These could be chemical catalysts or engineered biological agents like enzymes that are specifically tailored to break down particular waste components.

Although these components are often found in bio-refineries, we have noticed that bio-refineries in the pharmaceutical industry require highly sterile environments and significant ongoing operational costs, which can be prohibitive and complex to manage. The output should be valuable enough with margins to cover these costs. This often means its best to focus on investing in highly effective but narrowly applicable bioprocesses.

It's challenging for bioprocesses to compete against large-volume chemicals produced from petrochemical feedstocks, especially those manufactured in fully depreciated assets. The roadmap for the industrialization of biology suggests focusing on high-value specialties or unique biological processes that produce molecules unattainable through conventional chemistry, like neodymium biomining.

- Industrialization of Biology: A Roadmap to Accelerate the Advanced Manufacturing of Chemicals

Scarcity and Uniqueness of the Processed Product

We like businesses that process products from waste which are difficult to find elsewhere, particularly those with a shortage in supply. Some waste transformation processes result in a product with a concentration of materials higher than those found in conventional raw resources in certain geographies. This not only enhances the value of the processed product but also turns previously overlooked waste into a highly sought-after commodity. See our vanadium thesis as an example for what we see as an open opportunity to pursue.

We also target processes that are highly selective to a specific valuable product. A great opportunity for this would be a process that targets neodymium, a rare earth element used in permanent magnets. These permanent magnets are integral to the US national interest as they are found in everything from electric motors/generators to communication devices. However, the supply of neodymium is highly monopolized in adversarial territories (92% China unsurprisingly). Even if the market is considered small and large buyers are few, the need to localize this critical industry means that if a business can clearly produce the materials (whether from coal fly ash or bauxite residue) and be a local supplier at similar price to incumbents from China, they should outperform.

We have tended to avoid the broad waste to energy (WTE) sector due to the homogeneity of the end product. Covanta/Reworld ($3B market cap) is a waste to energy (WTE) solution business, operating 41 WTE facilities that process approximately 21m tons of solid waste annually. A green flag for Covanta is being mostly agnostic to the waste stream. This has allowed it to scale tremendously well by co-locating in a wide variety of areas. An obvious red flag to all WTE businesses is the commodity (energy) solution produced by processing the waste. This potentially limits a venture-scale outcome considering the relatively high Capex and Opex of a facility. We would prefer to see a high margin, scarce output produced via these waste streams that have strong pricing power.

To that end, consider the geographic context in which the waste valorization process is situated. If the area lacks natural alternatives for a critical resource and relies heavily on imports, a technology that can localize and secure the supply chain for these resources can attract significant government support and investment. These government incentives, such as tax credits, grants, or direct funding can significantly reduce startup and operational costs when trying to compete with a much larger incumbent with processes that are at significant scale and efficiency. You can use this resource to see a short list of potential US federal and state funders.

Diverse and Secured Access to Waste Feedstocks

An often overlooked characteristic to assess is whether a business has exclusive or preferred access to its required waste feedstocks. In markets where waste becomes a competitive feedstock due to its value in recycling or repurposing, having secured and diversified sources or durable long-term agreements ensures operational stability and profitability. We have seen examples where startups are able to establish clear agreements for the supply of waste with long-term commitments. This guarantees a steady input stream and helps in planning and scaling operations. Often, this is done with co-locating the processing facility with the waste source feedstock. This has the dual benefit of both guaranteeing supply and enhancing logistical efficiency.

The value of co-locating near sources can be seen in particular with spent nuclear fuel for reprocessing (a la our portfolio company Transmutex) but is also applicable for e-waste reprocessing to extract rare earths, lithium, semiconductor materials, etc. Spent nuclear fuel contains valuable materials such as uranium and plutonium, but it is highly radioactive and thus requires sophisticated technology and stringent safety measures for reprocessing. The regulatory hurdles and public concerns even prevent moving the nuclear waste across state or even county lines meaning natural monopolies could arise.

LanzaTech, which went public at a ~$2.2B market cap, leveraged this co-location strategy. LanzaTech transforms carbon-rich waste gases from industrial activities into sustainable products like aviation fuel, chemicals, and materials. Their system utilizes a proprietary microbial fermentation process, where specialized bacteria consume carbon monoxide and carbon dioxide from sources such as steel mills and refineries. These gases are converted into ethanol, a precursor to produce various products like sustainable aviation fuel or monoethylene glycol for PET plastics. LanzaTech has commercialized this technology by partnering with industrial facilities, installing compact fermentation units onsite to enable efficient carbon capture and conversion.

We also see ample opportunities for co-location for our friends at Maple Materials alongside oil field operators in the Middle East. Maple Materials is turning CO2 waste from oil fields into needle coke, a key precursor for graphite anodes used in lithium-ion batteries. This process not only helps in the reduction of CO2 emissions but also supports the growing demand for battery components outside of Chinese production (where the majority of graphite anodes are produced)

Approach Waste with Caution

Although we believe there are opportunities for investment in waste valorization (as demonstrated by our investment in Transmutex) given the importance of the tailwinds driving interest in the these technologies (climate + national security), we recommend approaching these technologies with caution. Waste valorization businesses often combine many of the existing challenges of investing industrial technologies (FOAK financing, longer development timelines, etc) with increased competition (vs primary suppliers) and increased operational complexity (securing feedstock sources + product off-take agreements). We are excited to meet the founders that believe they are capable of threading the needle in this critical facet of industrial technologies that has the potential to foster economic resilience.